2020 Healthcare Prognosis

As we all entered January 2020, many years into a historic bull run along (too?) many dimensions, few of us (well, maybe Stephon Marbury) had any idea what the next 4 months would bring. We have all had to adapt, finding resiliency and grace in the face of uncertainty and adversity. We have had to throw out the old playbook.

That includes our annual survey on the biggest news, trends and challenges facing the healthcare industry. We issued our survey on February 24, 2020, and over the course of the 2 week response period, the world began internalizing that COVID-19 would become a global pandemic, forever changing our everyday lives and dramatically altering the economy.

A bunch of the survey responses were “same old, same old”: Haven would not do much (who knew how right that would be); there would be more talk than action on drug prices; people are enamored of Farzad’s bow tie and epidemiology prowess… There was, however, a dramatic change in sentiment regarding COVID-19 and the economy over the course of the survey. As a result, we broke with tradition and issued two follow-up surveys in late March and April in order to track the rapidly changing sentiment elicited by COVID-19. These include timelines for a vaccine and drug treatment, stark economic predictions and questions about the virus’s impact on the upcoming presidential election and returning to work.

Our commentary on the most interesting findings is presented below, followed by the full results from all three surveys. Many thanks to the hundreds of people who took the time to share their views and opinions.

I. REALITY SETTLES IN

The grim reality of COVID-19 set in over the course of our surveys as deaths quickly and materially surpassed initial predictions.

THE ONLY PROBLEM?

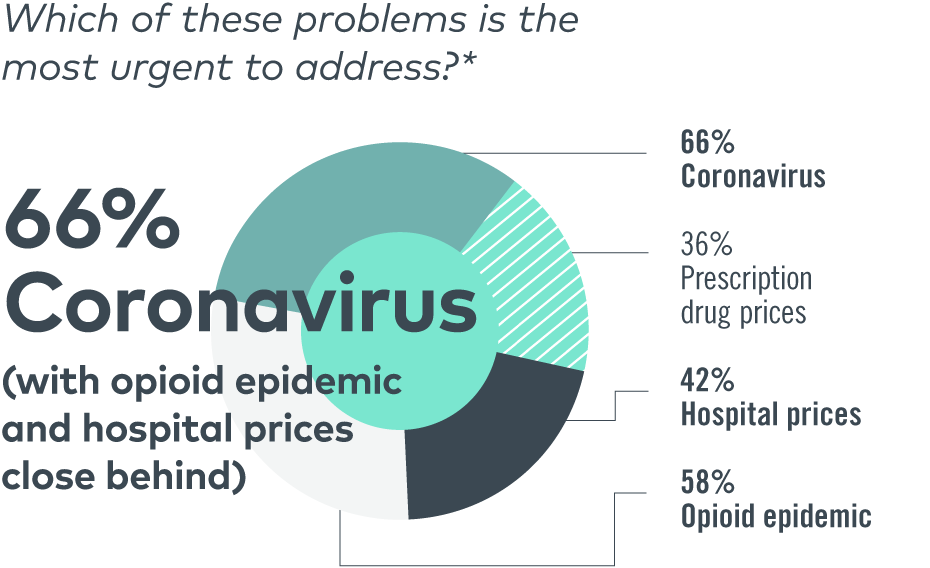

In the first survey, coronavirus barely outpaced opioids and hospital pricing as the #1 or #2 problem to address, while a full one-quarter of respondents cited it as the least urgent problem.

* For this question, we combined respondents’ most urgent and second most urgent responses.

GRIM PREDICTIONS

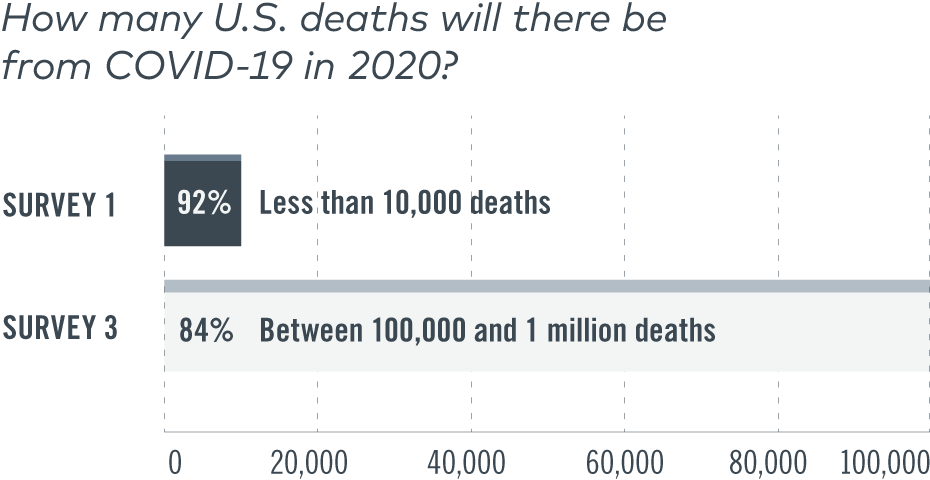

We all have been behind the curve on COVID and as a result keep revising the projected 2020 death toll upward. In our initial inquiry, only 8% of us felt there would be greater than 10,000 deaths... WOW... Super wrong… By survey 3, 84% of respondents predicted 100K-1MM deaths from COVID-19 in the U.S.

FUTURE OF HEALTHCARE IT

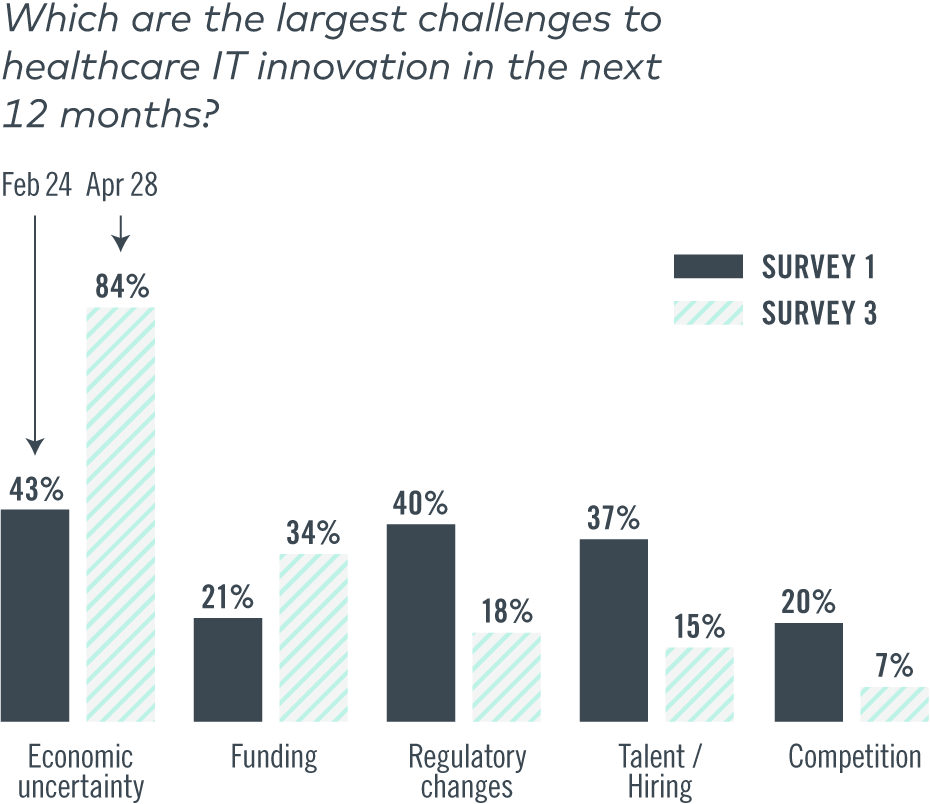

Economic uncertainty doubled (though we would argue it got a lot more certain... and a lot worse…) while talent concerns dropped by half. With the steepest job losses since the Great Depression, the war for talent is history. Now it’s the battle to get hired, even in healthcare — the layoffs in March marked only the fifth month in 30 years that the industry has shed any jobs at all.

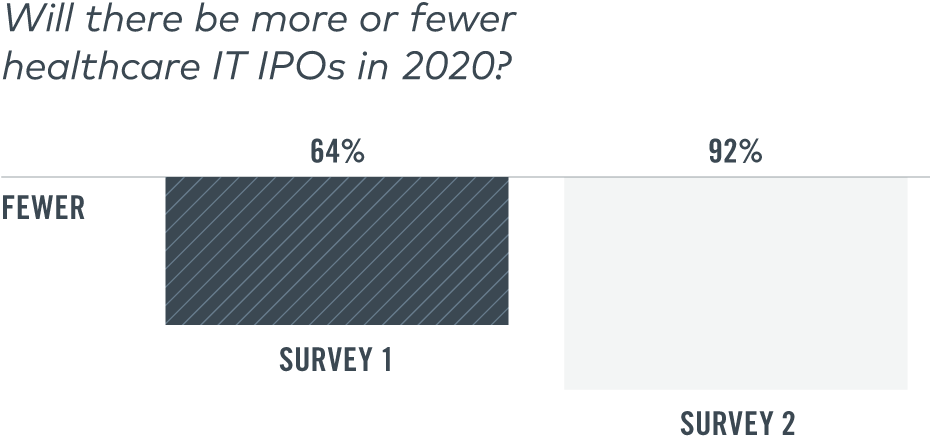

Not surprisingly, when asked to predict the number of healthcare IT IPOs in 2020, 92% expect fewer IPOs in 2020 in survey 2, compared to 64% in survey 1. The stock market apparently has not yet gotten the memo...

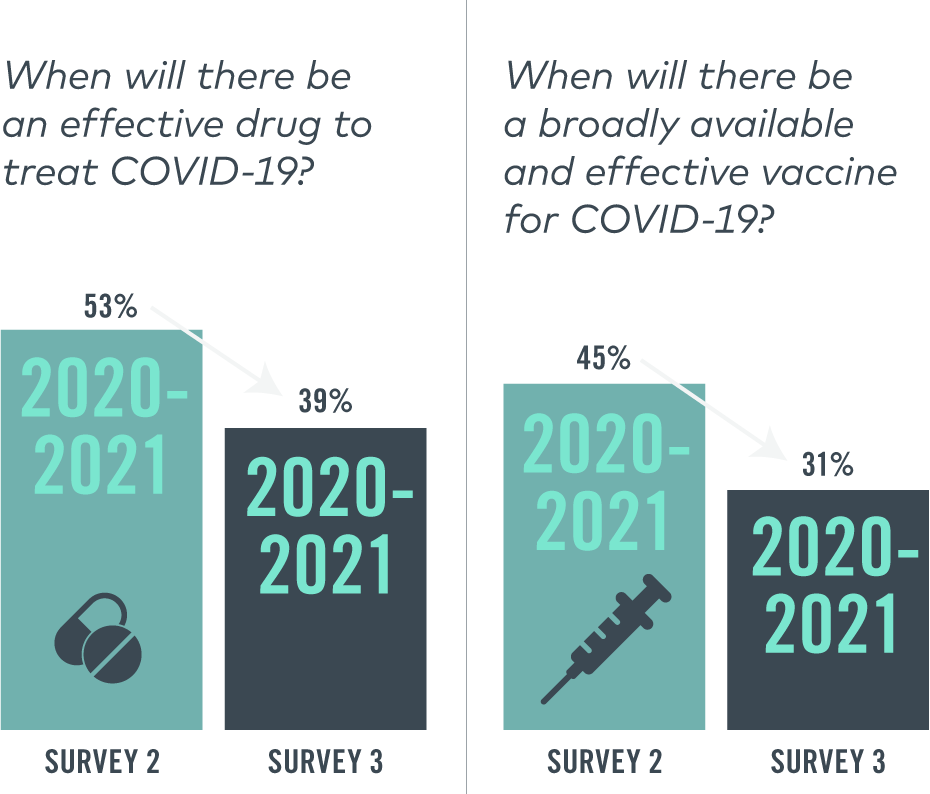

HOPES FADE FOR A NEAR-TERM TREATMENT

With so much talk about treatments (please don’t drink bleach) and vaccines for COVID-19, we asked our respondents to weigh in on when these dreams would become a reality. The world is learning what it means for a vaccine to be not only effective, but also broadly available, leading our respondents to hedge their predictions a bit over the course of our inquiries. Some of the most encouraging treatments involve plasma transfusions from recovered patients, yet confidence that an effective drug treatment will be available soon waned.

II. ECONOMICS CRASH COURSE

With skyrocketing unemployment numbers, shuttered businesses and for a time, negatively priced oil, the pandemic has ushered in new economic realities.

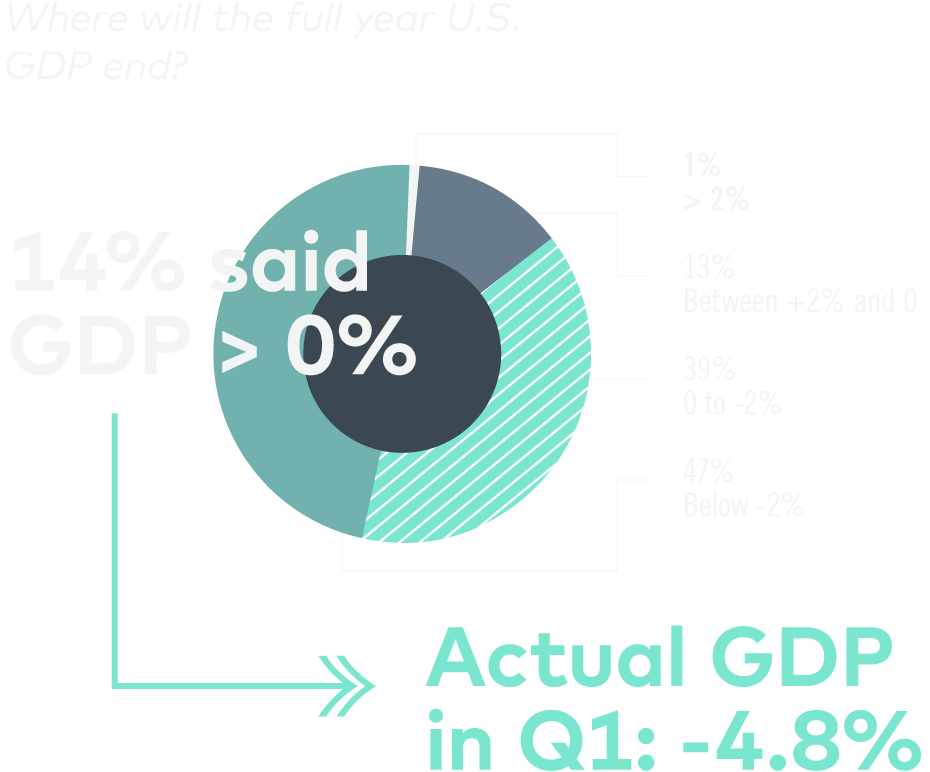

GDP WOES

In survey 2, only 47% of our respondents think U.S. GDP growth will decrease by more than 2% in 2020, while the actual GDP in Q1 2020 decreased 4.8% and consensus estimates for FY 2020 are currently negative 4-5%, showing either a difference of opinion on second-half economic strength or a reflection of more optimistic times a mere eight weeks ago.

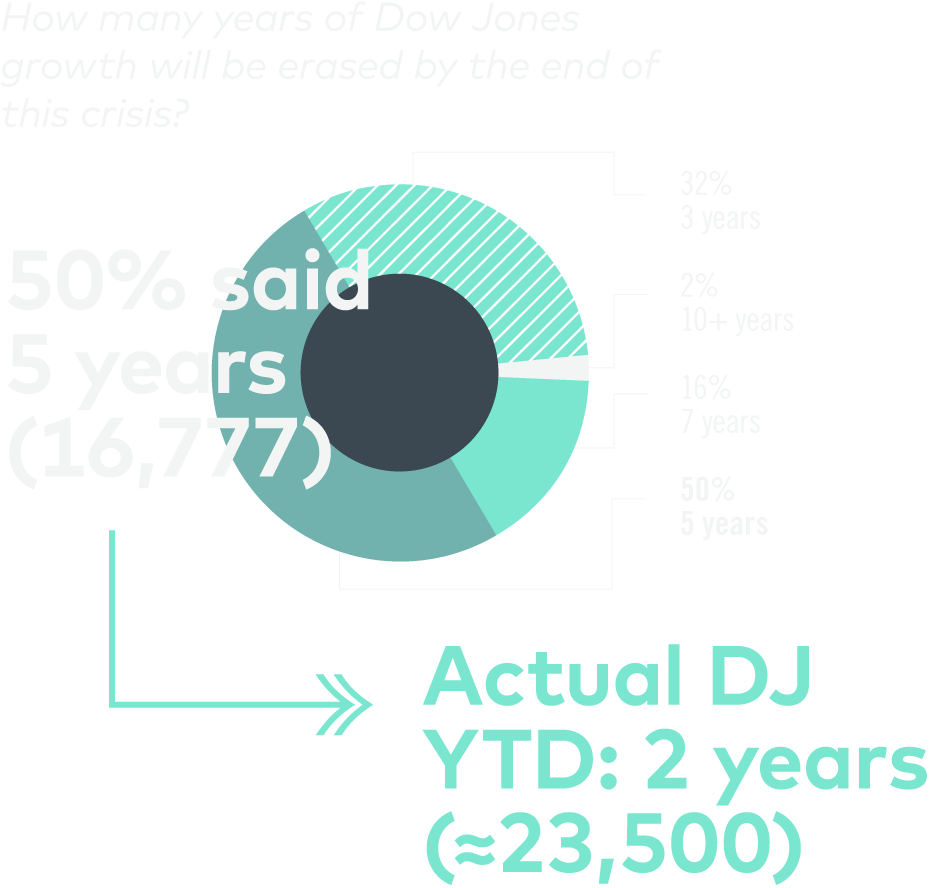

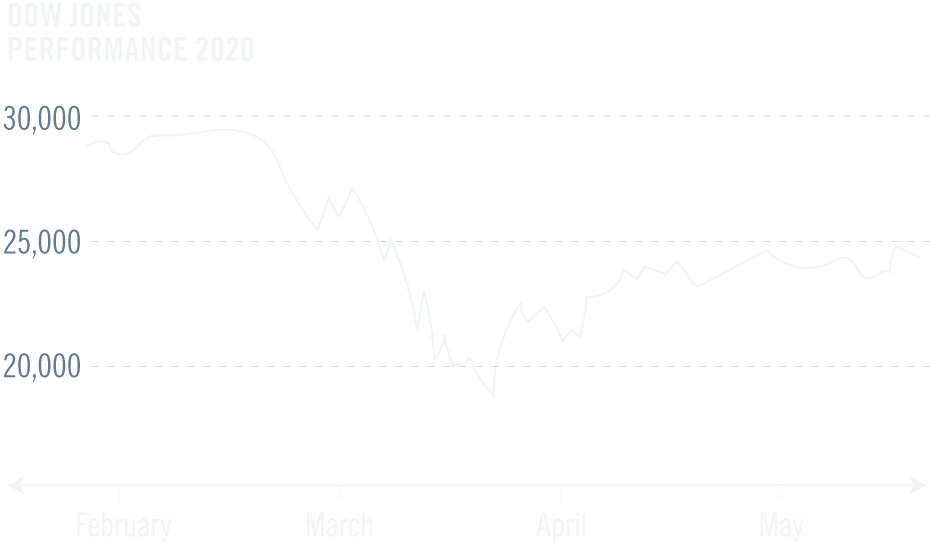

STOCK MARKET RALLIES

The stock market has been volatile, but when asked how many years of Dow Jones growth will be erased by this crisis, our respondents in survey 2 have yet to be proven right as the equity markets have proven surprisingly robust. We feel pretty good about this one, but will ask again next year to close the loop.

HEALTHCARE IMMUNITY?

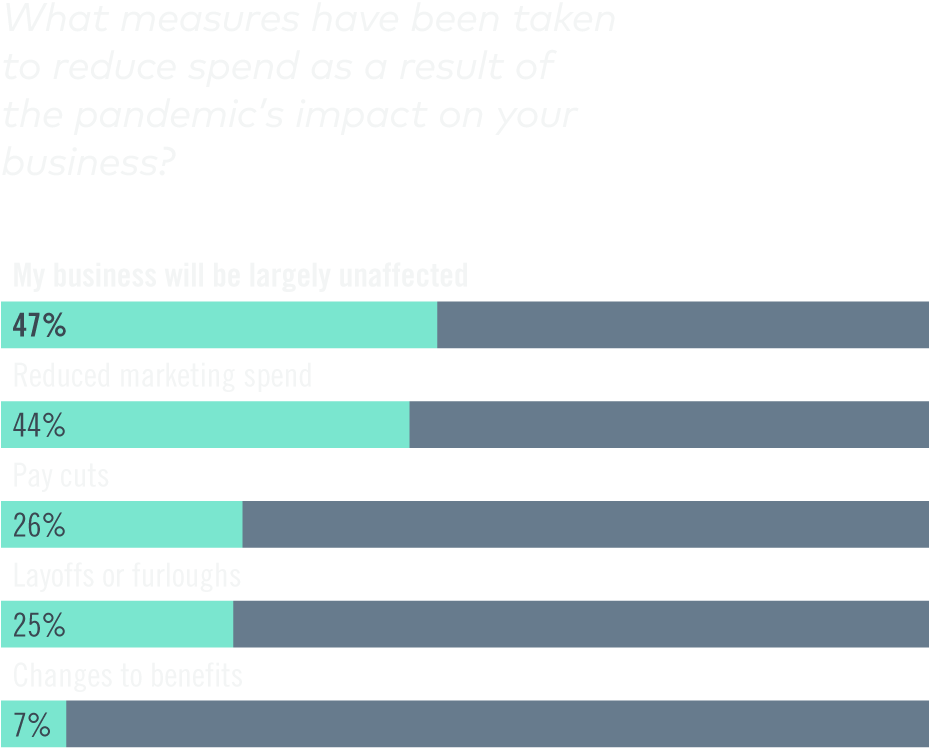

Nearly half of our respondents (47%) in survey 3 think their business will be unaffected by the pandemic. Is there a selection bias in healthcare or are people’s heads in the sand?

III. A NEW NORMAL

As many states begin a phased approach to reopening, we asked our respondents about the future, post-pandemic.

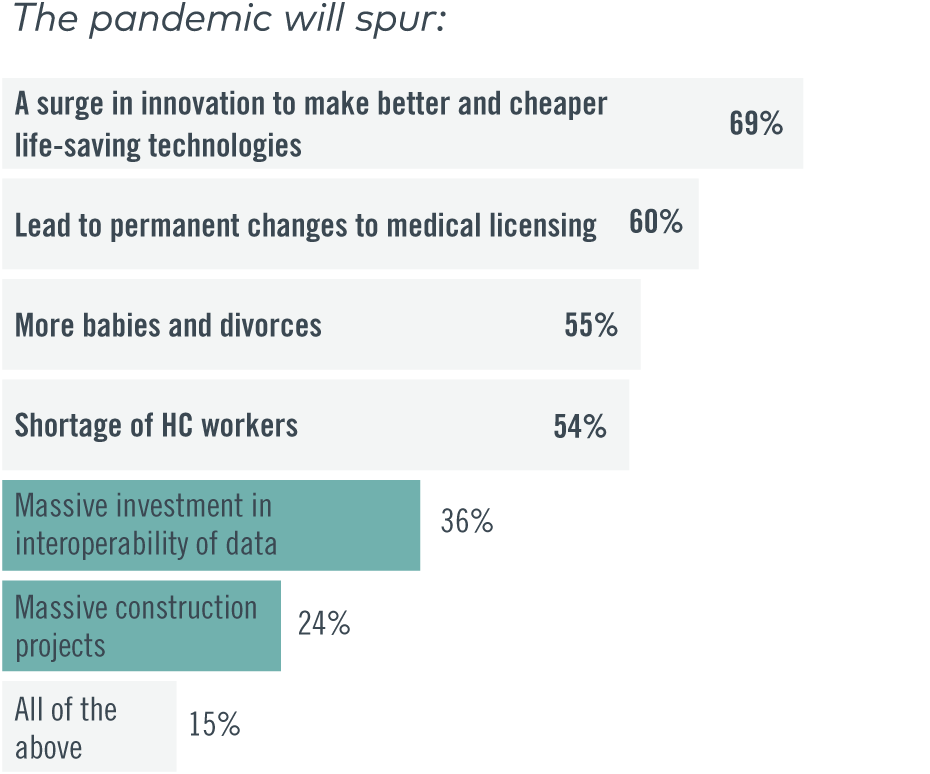

HEALTHCARE SHORTAGE?

While we’ve heard the jokes about more babies and divorces, our respondents caution that the pandemic will lead to a shortage of healthcare workers. Ironic, because healthcare saw steep job losses (1.4 million) in April due to lost revenue from fewer elective and routine procedures.

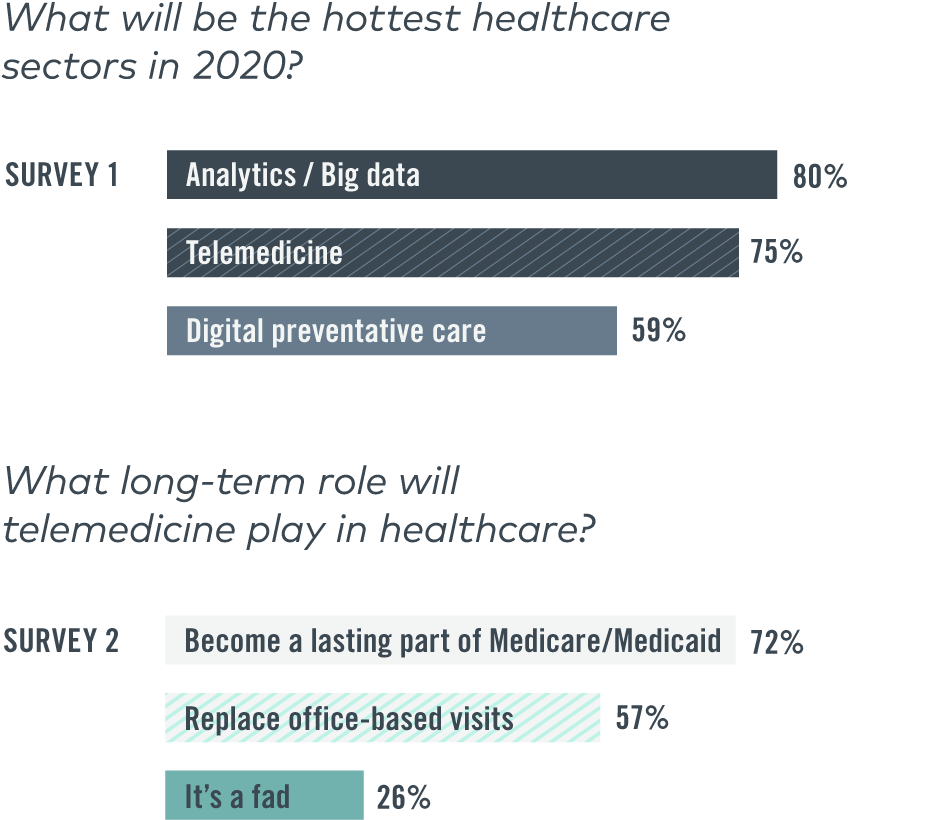

TELEMEDICINE’S SHINING MOMENT

Telemedicine was a consensus bet before the pandemic… though one-quarter of respondents think the telemedicine surge is a 12 week fad. The majority also believes that telemedicine will become a permanent part of healthcare thanks to loosened restrictions for Medicare and Medicaid populations.

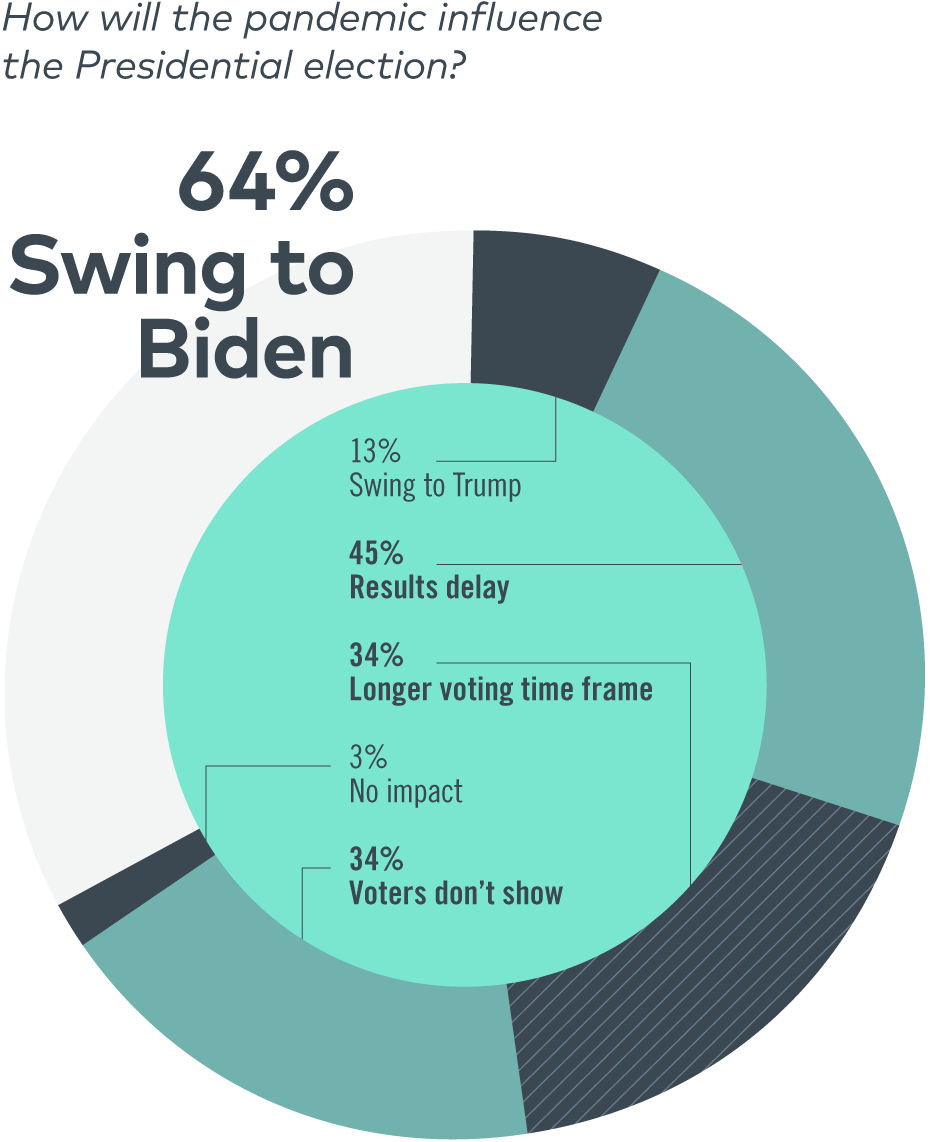

PRESIDENTIAL RESPONSE?

The majority of our respondents think the pandemic will help swing voters to Biden, but there’s a long time before November. Many also predict a results delay from mail-in ballots and more voter no-shows thanks to heightened anxiety around going to the polls.

GROUNDHOG DAY... AGAIN

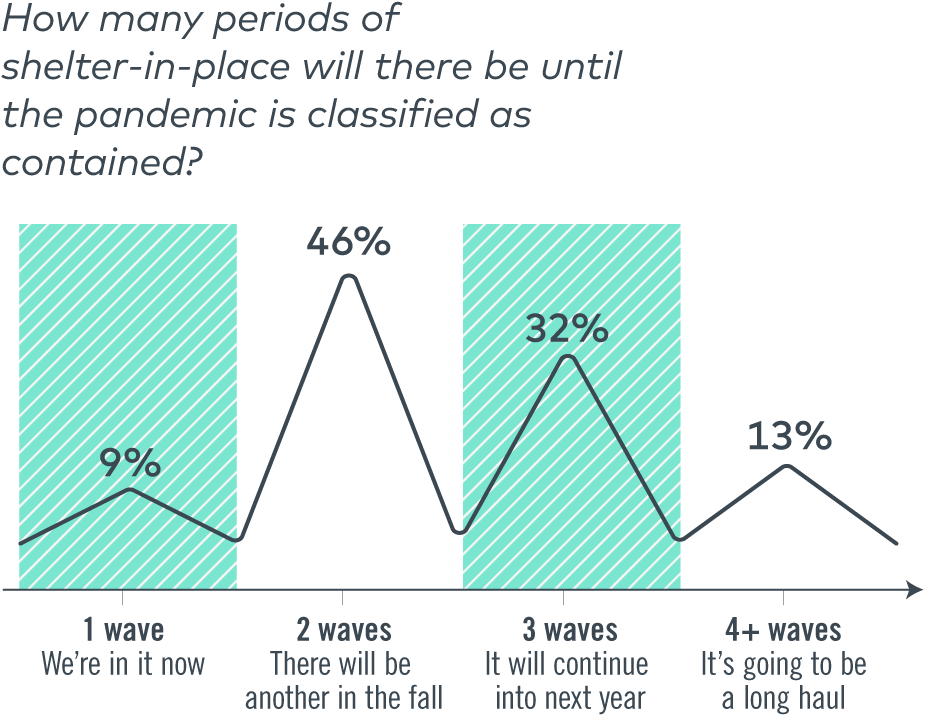

Grab your sweatpants, sourdough starters and toilet paper rolls, the majority of our pundits think this is a 2-3 wave problem, perhaps modeling the 1918 Spanish flu with a tail into 2021.

OUT OF OFFICE

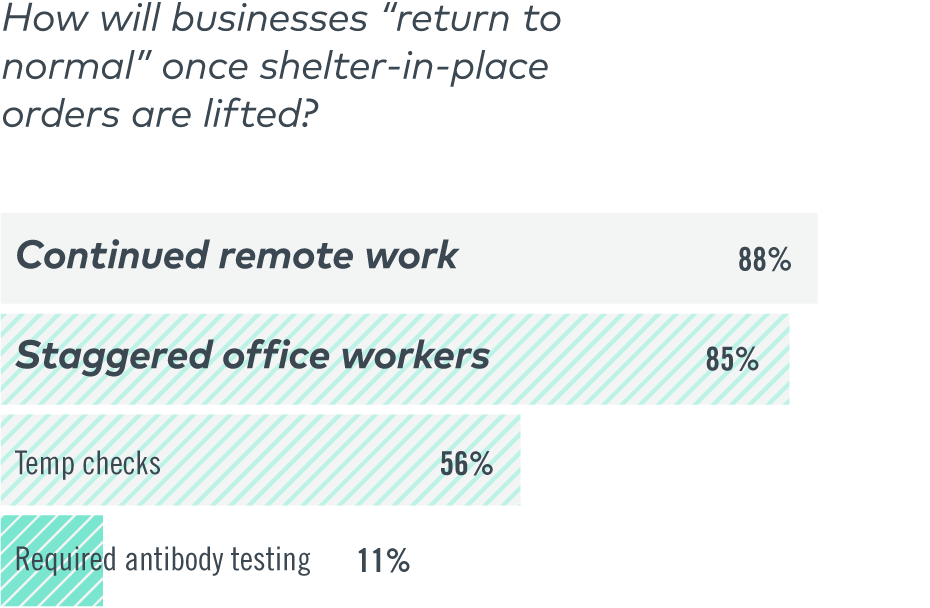

Our respondents predict that many companies will continue working remotely until a vaccine is available (or longer), but for others, staggered days in the office and temperature checks at the door will become the norm. Only 11% predict that employers will require antibody testing, yet Amazon is working to build a testing lab on campus for employees and other large employers are discussing testing strategies to ensure the safety of their workers.

Full Survey Results

Respondents from health IT startups, large employers, insurance companies, healthcare providers, academics, the government, investors and professional service providers conducted the three surveys during the timeframes listed below:

Survey 1: February 24 – March 6, 2020

269 respondents

Survey 2: March 22 – April 3, 2020

294 respondents

Survey 3: April 28 – May 6, 2020

320 respondents

If you would like to view the results of our previous surveys, you can find them here:

2019 Healthcare Prognosis

2018 Healthcare Prognosis

2017 Healthcare Prognosis

SURVEY 1 February 24 - March 6, 2020

1

How will the results of

the 2020 Presidential

election impact the

future of the U.S.

healthcare system?

| 31% | Positive changes are coming |

| 54% | It won't matter |

| 15% | We will travel to Canada for healthcare |

2

Which of the following

are the largest

challenges to

healthcare IT

innovation in the next

12 months?

| 37% | Talent/hiring |

| 40% | Regulatory changes |

| 43% | Economic uncertainty |

| 20% | Competition |

| 21% | Funding |

3

Will prescription drug

prices be curtailed in

the next four years?

| 11% | Yes, meaningfully |

| 75% | Only a little, with WAY more talk than action |

| 4% | Yes, voluntarily by pharma |

| 10% | No, nothing will happen |

4

The industry is about

to face a backlash for

violating patient trust

and privacy by

harvesting and

reselling client data:

| 47% | Agree, there will be consequences |

| 53% | Disagree, nothing will happen |

5

Do you like the below

HCIT segment more or

less than in 2019:

| Accountable Care Organizations | |

| 54% | More |

| 46% | Less |

| Wearables / Consumer Sensors | |

| 47% | More |

| 53% | Less |

| Insurance | |

| 49% | More |

| 51% | Less |

| Telemedicine | |

| 75% | More |

| 25% | Less |

| EHRs | |

| 30% | More |

| 70% | Less |

| Digital preventative care programs / wellness | |

| 59% | More |

| 41% | Less |

| Analytics and big data | |

| 80% | More |

| 20% | Less |

6

There will be ______

HCIT IPOs in 2020 (1

to date) than in 2019

(5 total)

| 36% | More |

| 64% | Fewer |

7

Which of these

companies will go

public in 2020? Select

all that apply.

| 43% | Accolade |

| 12% | Agilon |

| 28% | American Well |

| 25% | Bright Health |

| 18% | Clover |

| 42% | GoodRx |

| 23% | Grand Rounds |

| 12% | MDLive |

| 26% | Oscar |

| 8% | Other (please specify) |

8

If you had $250 to

short these public

companies at their

current valuations,

how would you

allocate it?

| Castlight | |

| 17% | $0 |

| 40% | $50 |

| 26% | $100 |

| 7% | $150 |

| 0% | $200 |

| 10% | $250 |

| Livongo | |

| 8% | $0 |

| 37% | $50 |

| 33% | $100 |

| 13% | $150 |

| 6% | $200 |

| 3% | $250 |

| One Medical | |

| 14% | $0 |

| 33% | $50 |

| 27% | $100 |

| 16% | $150 |

| 2% | $200 |

| 8% | $250 |

| Phreesia | |

| 27% | $0 |

| 49% | $50 |

| 19% | $100 |

| 3% | $150 |

| 3% | $200 |

| 0% | $250 |

| Progyny | |

| 16% | $0 |

| 56% | $50 |

| 20% | $100 |

| 7% | $150 |

| 0% | $200 |

| 1% | $250 |

| Teladoc | |

| 17% | $0 |

| 46% | $50 |

| 23% | $100 |

| 9% | $150 |

| 1% | $200 |

| 4% | $250 |

9

Will there be a

crackdown in

direct-to-consumer

prescription

companies such as

Hims, Roman, Nurx

and Lemonade?

| 38% | Yes |

| 62% | No |

10

What effect will the

travails of Softbank

have on the

healthcare IT

ecosystem?

| 34% | Put downward pressure on valuations |

| 15% | Squeeze late stage funding |

| 4% | Increase the number of startups going public or getting acquired |

| 47% | Nothing, there is so much capital available that it won't matter |

11

In 2020, Juul will end

the year:

| 3% | With all flavored products banned |

| 31% | With new regulatory constraints on marketing |

| 55% | Both A and B |

| 11% | Growing faster than ever |

12

In 2020, Amazon will

(select all that apply):

| 53% | Launch a PBM and a rapidly growing pharmacy business |

| 31% | Launch an Alexa-style diagnosis chat bot |

| 38% | Buy healthcare services businesses (e.g., primary care, tech-enabled disease management companies) |

| 59% | Primarily focus on selling AWS to health systems and payors |

13

Haven’s post-rookie /

junior season results

will be:

| 58% | A few small and little-noticed pilots |

| 5% | A big bang of actions that are surprisingly innovative and ambitious |

| 37% | Marred by delays and founding partner politics |

14

Which of these

problems is the most

urgent to address?

1 = Most urgent

4 = Least urgent

| Coronavirus outbreak | |

| 53% | 1 |

| 13% | 2 |

| 10% | 3 |

| 24% | 4 |

| Opioid epidemic | |

| 18% | 1 |

| 40% | 2 |

| 26% | 3 |

| 16% | 4 |

| Prescription drug prices | |

| 11% | 1 |

| 25% | 2 |

| 33% | 3 |

| 31% | 4 |

| Hospital prices | |

| 20% | 1 |

| 22% | 2 |

| 30% | 3 |

| 28% | 4 |

15

Total U.S. deaths in

2020 from the novel

coronavirus will be:

| 8% | 10 |

| 24% | 100 |

| 43% | 1,000 |

| 16% | 10,000 |

| 8% | Greater than 10,000 |

16

What, if anything,

will quell the opioid

epidemic in 2020?

| 7% | Digital treatment solutions |

| 35% | Policy change |

| 21% | Better integration between EHRs and prescription drug monitoring programs (PDMP) |

| 37% | New and effective non-addictive pain medications |

17

Who is the best

Founder CEO in the

HCIT ecosystem?

| 8% | Farzad Mostashari |

| 8% | Todd Park |

| 7% | Ed Park |

| 6% | Jonathan Bush |

| 6% | Sami Inkinen |

| 5% | Judy Faulkner |

| 4% | Owen Tripp |

18

Which category

best describes your

employer?

| 21% | Healthcare IT provider |

| 6% | Large employer |

| 8% | Insurance |

| 10% | Healthcare provider |

| 2% | Academia |

| 1% | Government |

| 26% | Investor |

| 12% | Professional services |

| 14% | Other (please specify) |

SURVEY 2 March 22 - April 3, 2020

1

When will there be an

effective (largely

solves mortality) drug

to treat COVID-19?

| 53% | 2020-21 |

| 40% | 2022-23 |

| 7% | More than 5 years |

2

When will there be a

broadly available and

effective (prevents

infection) vaccine for

COVID-19?

| 44% | 2020-21 |

| 52% | 2022-23 |

| 4% | More than 5 years |

3

How many years of

Dow Jones growth

will be erased by the

end of this crisis [high

was 29,551.42; we are

hovering around

18,800 now]?

| 32% | 3 years [17,927.11 in 2016] |

| 50% | 5 years [16,777.69 in 2014] |

| 16% | 7 years [12,966.44 in 2012] |

| 2% | 10+ years [below 10,668.58] |

4

For the full year 2020,

the U.S. GDP will be…

| 14% | >0% |

| 39% | 0 to -2% |

| 47% | Below -2% |

5

The pandemic will

spur... [Select all that

apply]

| 36% | Massive investment in inter-operability of real time healthcare data |

| 24% | Massive construction projects to increase hospital bed and ICU bed surge capacity |

| 54% | Shortages of healthcare workers that are felt into 2021 |

| 69% | A surge in innovation to make better and cheaper life-saving technologies, such as respirators and protective gear for healthcare providers |

| 55% | More babies and divorces |

| 60% | Lead to permanent changes in the U.S. around medical licensing and enable clinical practice across state lines |

| 15% | All of the above |

6

What does the future

of telemedicine look

like? [Select all that

apply]

| 57% | Will replace a large amount of office-based primary care visits, driving massive growth |

| 26% | Will be trendy for 6 months and then return to normal usage rates |

| 72% | Will be made permanent parts of the Medicare and Medicaid programs |

7

There will be ______

HCIT IPOs in 2020 (1

to date) than in 2019

(5 total)

| 8% | More |

| 92% | Fewer |

8

There will be ______

U.S. deaths from

COVID-19 in 2020.

| 6% | Under 10K |

| 34% | 10-100K |

| 55% | 100K-1MM |

| 4% | 1MM-10MM |

| 0% | More |

SURVEY 3 April 28 - May 6, 2020

1

Which of the following

are the largest

challenges to

healthcare IT

innovation in the next

12 months? [Select all

that apply.]

| 15% | Talent/hiring |

| 18% | Regulatory changes |

| 84% | Economic uncertainty |

| 7% | Competition |

| 34% | Funding |

2

When will there be an

effective (largely

solves mortality) drug

to treat COVID-19?

| 39% | 2020-21 |

| 52% | 2022-23 |

| 9% | More than 5 years |

3

When will there be a

broadly available and

effective (prevents

infection) vaccine for

COVID-19?

| 31% | 2020-21 |

| 63% | 2022-23 |

| 6% | More than 5 years |

4

There will be ______

U.S. deaths from

COVID-19 in 2020.

| 14% | 10-100K |

| 84% | 100K-1MM |

| 2% | 1MM-10MM |

| 0% | More |

5

How will the

pandemic influence

the Presidential

election? [Select all

that apply]

| 13% | Swing voters to Trump |

| 64% | Swing voters to Biden |

| 34% | Voters don’t show |

| 45% | Results delay due to massive mail-in |

| 34% | Longer voting timeframe to allow for social distancing and disinfecting of voting sites |

| 3% | No impact |

6

How many periods of

shelter-in-place will

there be until the

pandemic is classified

as contained?

| 9% | 1 – We’re in it now |

| 46% | 2 – There will be a wave in the fall |

| 32% | 3 – This will continue into next year |

| 13% | 4+ - It’s going to be a long haul |

7

How will businesses

return to “normal”

once shelter-in-place

orders are lifted?

[Select all that apply]

| 85% | Staggered amounts of people allowed in the office at one time to encourage physical distancing |

| 56% | Temperature checks before entry |

| 88% | Continued remote work for majority of workers, decrease dependency on physical office |

| 11% | Mandatory antibody testing before reopening |

8

What measures have

you taken to reduce

spend as a result of

the pandemic’s

impact on your

business? [Select all

that apply]

| 25% | Layoffs or furloughs |

| 44% | Reduced marketing spend |

| 26% | Pay cuts |

| 7% | Changes to benefits |

| 47% | My business will be largely unaffected |